Community Resources

Introducing the HOPE Village

Neighborhood Resources

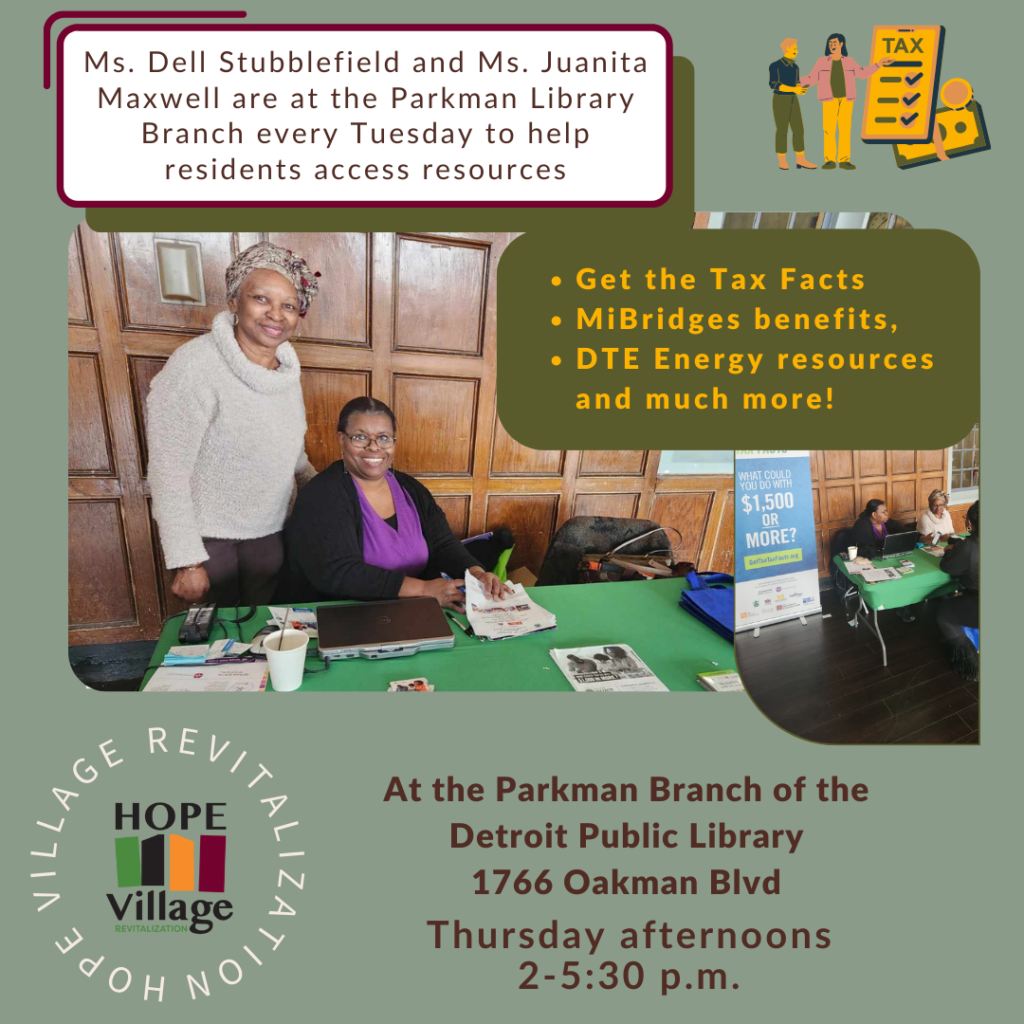

Ms. Juanita Maxwell is the HOPE Village Neighborhood Resource Navigator. She provides one on one support for neighborhood residents to connect them with valuable resources, including MiBridges, Earned Income Tax Credit, Child Tax Credit, Affordable Connectivity Program, and much, much more! Ms. Maxwell is available to assist Hope Village residents Monday through Thursday by appointment. Connect with Ms. Maxwell here (juanita.maxwell@hopevillagecdc.org)

___________________________________________________________

Ms. Dell is the HOPE Village Community Engagement Specialist. With her extensive background in community outreach and development, Ms. Dell is dedicated to fostering strong connections and enhancing the quality of life for all our residents. Connect with Ms. Dell here (dells@hopevillagecdc.org).

Financial Resources

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) provides a tax credit to working people with low to moderate income. Qualifying individuals receive a cash lump-sum payment (via direct deposit or paper check) at tax time. This year, changes to EITC eligibility rules mean more people qualify than before. Specifically, the income limits and amount of the credit have increased significantly for individuals and married couples without children.

To claim your credit, you must file a tax return, even if you do not owe any tax or are not otherwise required to file. If you worked full or part time last year, you may qualify for the credit.

Sign up here for a free in person or virtual tax prep session and get your taxes done right! Or, if you prefer to do your taxes yourself, use United Way of Southeastern Michigan’s free tax tools here.